Medicare Coverage Simplified

Getting Medicare

Do You Need?

The Process for Getting Medicare

Original Medicare

Medicare Advantage Plans

What Parts of Medicare Do You Need?

Original Medicare: Parts A and B

Medicare Part A, often referred to as “Hospital Insurance,” covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. It provides essential coverage for hospital stays, surgeries, and related medical services required during a hospital stay. It’s a fundamental component of Original Medicare, helping beneficiaries access critical healthcare services.

Medicare Part B, often called “Medical Insurance,” covers a wide range of outpatient medical services. This includes doctor visits, preventive care, diagnostic tests, durable medical equipment, ambulance services, and certain outpatient therapies. Part B plays a crucial role in ensuring access to necessary medical care outside of a hospital setting, helping beneficiaries manage and maintain their health. It’s an essential component of Original Medicare.

Do you also need prescription drug coverage?

If your answer is “yes”, you’ll also want Medicare Part D as unless you have other drug coverage.

Medicare Part D, also known as Prescription Drug Coverage, is a vital component of Medicare that helps beneficiaries manage their prescription medication expenses. This coverage can be added to Original Medicare (Part A and Part B) or chosen as part of a Medicare Advantage plan. Part D plans are offered by private insurance companies approved by Medicare.

Medicare Advantage Plans

If there are additional health benefits you’re looking for—like dental and vision as well as prescription drug coverage–you may want to consider a Medicare Advantage Plan, which can provide all the benefits of traditional Medicare along with additional health benefits in one convenient/comprehensive plan.

Medicare Part C, often referred to as a Medicare Advantage plan, is an alternative to Original Medicare (Part A and Part B). These plans are offered by private insurance companies approved by Medicare. Part C plans combine the benefits of Parts A and B and often include additional coverage, such as prescription drug coverage (Part D), dental, vision, and wellness programs.

Medicare Advantage plans provide all-in-one coverage.

Medicare Advantage plans make it convenient for beneficiaries to receive their healthcare services through a single plan. While they must cover everything that Original Medicare covers (except hospice care, which is still covered by Part A), Part C plans can offer extra benefits and may have different rules, costs, and restrictions. These plans aim to provide a comprehensive and cost-effective way to manage healthcare needs. When choosing a Medicare Advantage plan, it’s important to consider factors like premiums, network providers, and coverage options to find the plan that best suits your health and financial needs.

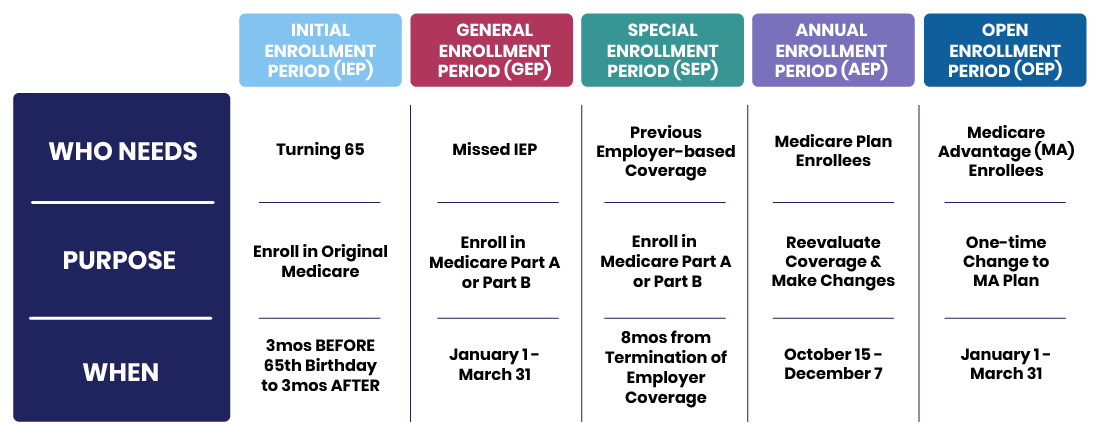

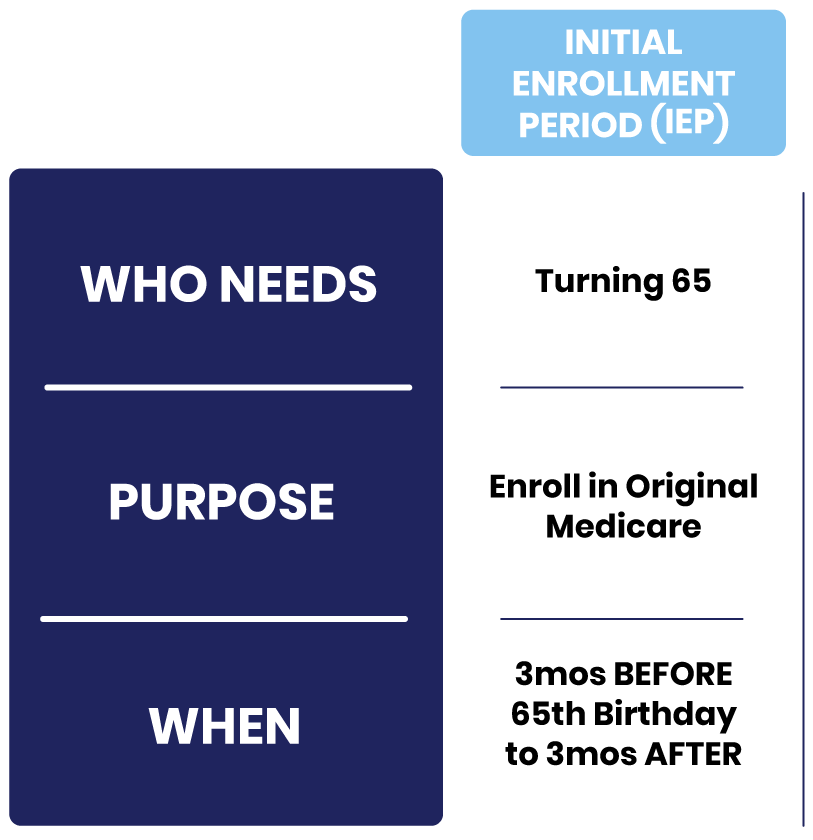

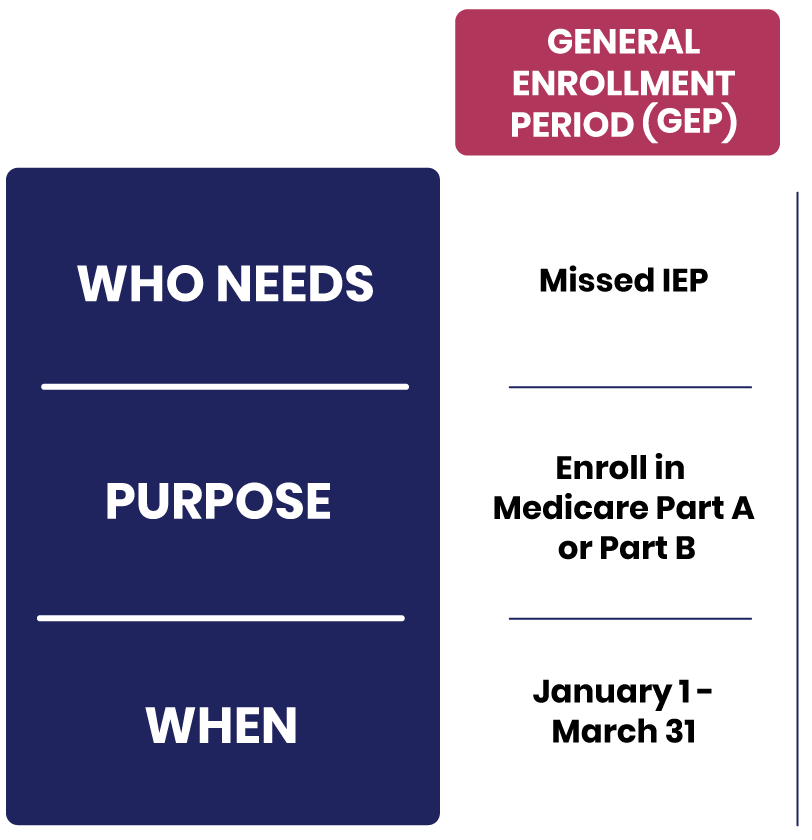

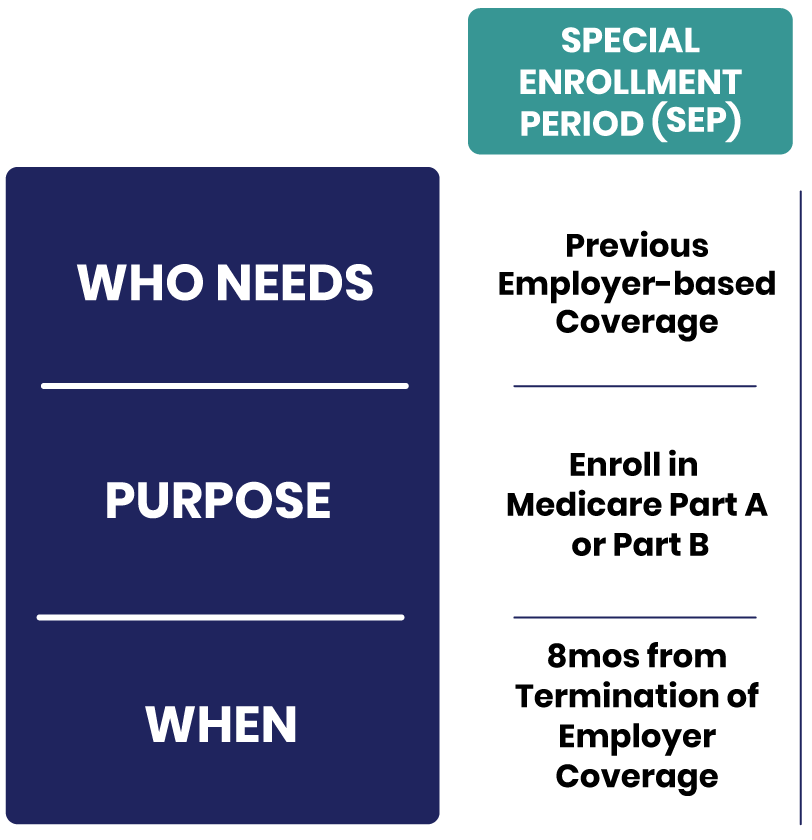

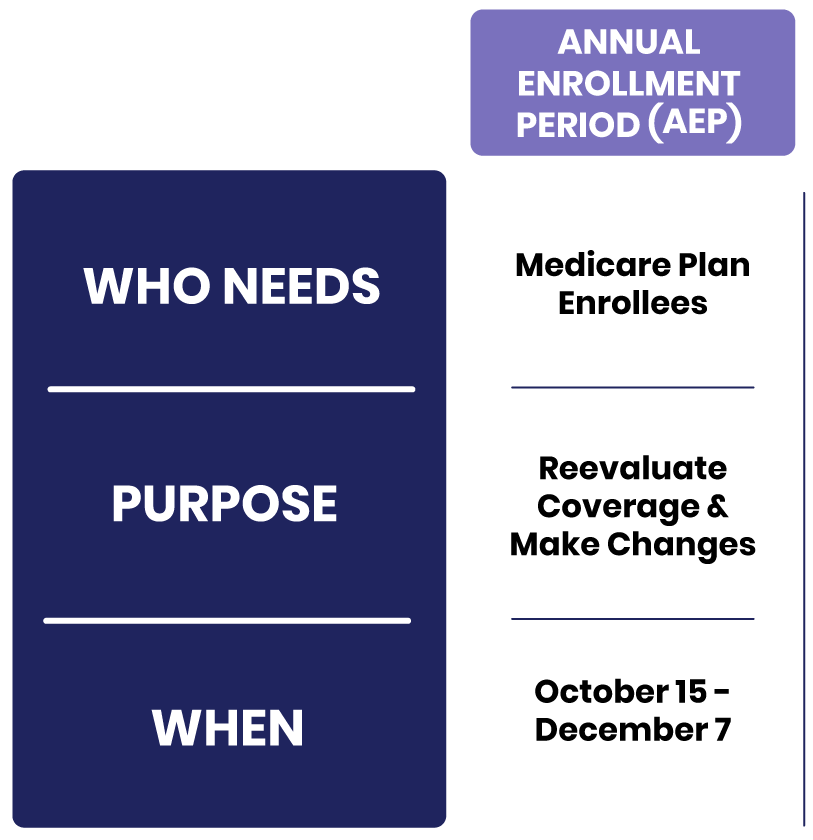

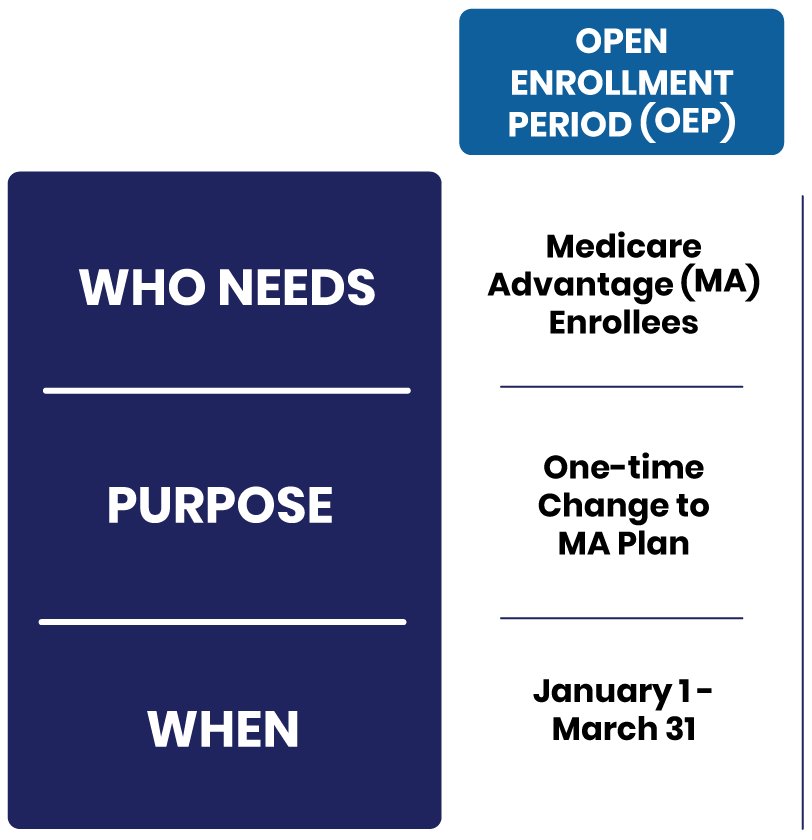

Medicare Enrollment Periods

is With You from Start to Finish

Step 1

Start with a free consultation. Fill out our form or call to discuss your needs.

Step 2

We ask questions to get to know you and understand your healthcare requirements.

Step 3

Identify your eligibility and explore personalized options to present.

Step 4

Secure the best coverage. We simplify enrollment and confirm your plan.

Step 5

Yearly check-ins ensure your plan aligns with your needs.

Step 6

Testimonials

What Our Clients Say

What a delightful knowledge woman. I would never have gotten through this maze of information without her guidance. I would gladly recommend Wanda to all of my family and friends.